If you’re based in the UK and you currently have (or are being offered) a provider with ~1% transaction fee, it’s good to explore alternatives to compare features, pricing, and fit. Here are several UK-friendly payment processing providers + key things to check, so you can pick the best fit for your business either as an addition to your website or through a marketplace/platform such as Patreon or Creator Gems.

Here are a 7 online payment providers we’ve reviewed (all UK-based / UK-relevant) and what they offer to help you decide which one could work best for your business.

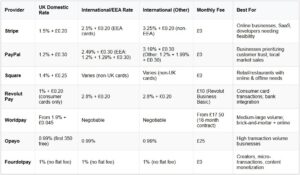

UK online payment solutions compared

1. Stripe

- Stripe charges 1.5% + €0.20 for UK card for UK based businesses.

- Cards issued in EEA have charges of 2.5% + £0.20 and 3.25% + £0.20 for international cards.

- Pros: Excellent developer tools and API, extensive documentation, wide range of integrations, no monthly fees, supports subscriptions and complex billing, fast setup.

- Considerations: Relatively high fees for larger as well as smaller transactions.

- Fit: Ideal for online businesses, SaaS companies, and startups wanting flexibility and powerful features without monthly commitments.

You can start accepting payments immediately with Stripe Checkout or build custom integrations.

2. PayPal

- PayPal UK domestic payments are charged at 1.2% + £0.30 per transaction.

- For international transaction (cards issued outside UK where merchant is located) there is additional charge of 1.29% for EEA issued cards or 1.99% additional charges for all other markets.

- Pros: Widely recognised and trusted by consumers, easy integration, buyer protection builds customer confidence, no monthly fees.

- Considerations: Potential account holds/limitations; customers may need PayPal accounts for best rates; disputes often favour buyers.

- Fit: Good for businesses where customer trust is paramount, or where many customers already use PayPal. Works well for mid-sized transactions.

PayPal is recognised as secure payment option. If you are selling on a local market fees may be acceptable, but if you have plans to sell internationally the international fees will quickly add up and eat into your margin which is especially the case for small transactions.

3. Fourdotpay

- Fourdotpay charges only 1% transaction fee without any flat fee.

- No monthly subscription or any other hidden costs.

- Pros: Secure, reliable and easy to use payment wallet used for online payments, QR code payments or instant wallet transfers. Required registration that takes only 3 minutes. Multiple online integration options available: SDK, API or plugin.

- Considerations: Require creation of a digital wallet which needs to be topped up to make purchases (via credit card, Google Pay, Apple pay or bank transfer).

- Fit: For creator-based businesses or individuals that are looking for affordable way to monetise their content.

The payment solution with industry lowest transaction fees. Specialised for small value transactions or so-called micro transactions.

4. Square

- Costs for online payments are charged at 1.4% + £0.25 per transaction for mayor credit cards.

- Pricing can vary if you accept other card brands or non-UK cards.

- Pros: Unified platform for online and in-person payments, free POS software, simple pricing, no monthly fees for basic plan, quick setup, next-day transfers.

- Considerations: Limited customization compared to Stripe; primarily UK/US-focused; fewer third-party integrations than Stripe; may hold funds initially for new accounts.

- Fit: Excellent for retail businesses wanting both online and offline payment processing, restaurants, small businesses preferring simplicity over extensive customization.

Square seems like affordable option for physical stores that also sell online as there are no monthly fees for POS terminal and you pay as you go.

5. Revolut Business – Revolut Pay

- Revolut Business lists a processing fee of 1% + a flat 20p for UK domestic consumer cards.

- For international cards the fee is higher and goes up to 2.8% + £0.20.

- Pros: Good for businesses who want bank-account style integration, maybe simpler setup.

- Considerations: Flat fee + % means the absolute cost may increase for larger ticket sizes; the 1% may only apply for consumer cards (not commercial/AmEx).

- Fit: If your customer base pays with consumer cards and you want a competitive rate.

Revolut’s payment gateway has a commercial name Revolut Pay. To apply for Revolut Pay, you need to be a Revolut Business client where Basic plan cost £10 per month.

6. Worldpay

- Worldpay online fees for online payments start from 1,9% + 4,5p authorisation fee. These fees depend on your annual revenue and probably also on your negotiation skills when opening the account.

- Pros: Very widely used, strong brand, broad feature set, lots of integration options.

- Considerations: “Starting from” means you may need good volume or negotiation to get best rate.

- Fit: If you have moderate to large volume, want a known brand, maybe credit card payments internationally.

To use Worldpay services either for POS terminal or online payment you need to have an account with them. There is not clear pricing list on their website that would reveal this information, but looking at the recent comparison, we found out that online payment gateway is included in the package when you rent a POS. Their lowest Simplicity Pricing Plan costs £17.5 per month (18 month- contract). Due to their terms, the Worldpay solution might be more suitable for brick-and-mortar businesses that have also their online store.

7. Opayo

- Opayo’s “Online Payments” plan shows 0.99% transaction fee where first 350 transactions are free.

- Online payments plan starts at £25.

- Pros: UK-centric, strong for online payments, established.

- Considerations: There is monthly fee for using Opayo’s online payments.

- Fit: If you are okay with a monthly fee and want that 1% rate.

A good option for large number of transactions which lowers the fixed rate per transaction.

Some of the services described are digital wallets

A digital wallet (also called an e-wallet) is a service that lets users store funds or link cards/bank accounts to make online payments more easily, without entering card details each time.

PayPal, Apple Pay, Google Pay are also digital wallets, but they are so widely used that they are considered as regular payment solution. PayPal is a classic digital wallet where users pay with stored PayPal balance or linked card.

What are the benefits of digital wallets?

Digital wallets usually provide instant and faster settlement. Funds land directly into your wallet account, not a separate bank, so no 2-3 day clearing delay.

Revolut and Fourdotpay give same-day or instant settlement for their in-wallet payments.

Digital wallets usually have lower or simpler fees

Because there’s no intermediary (no acquiring bank to pay interchange markup), the wallet provider can offer flat low fees (like that 1% that Fourdopay is charging).

Potential Downsides

Limited payment method support – Wallets may not support all card types or alternative methods. Stripe and Adyen, by contrast, support hundreds of payment types.

Regulatory coverage & buyer protection – Wallets are regulated as “e-money institutions” (FCA in the UK), not full banks — so FSCS deposit protection does not apply (though they segregate funds). That also applies for Revolut and Paypal and we are all suing these services without any concerns.

Payment gateway comparison table

Our comparison of online payment gateways demonstrates that Fourdotpay as the cheapest and easiest to set up solution for monetising digital content in the UK. Due to the low fee (of just 1%) and no fixed costs for transaction we focused on the transactions below £20 where the majority transactions occur. With our easy to install SDK, plugin or API you could transform your website into a market in literally hours not days.

If you find Fourdotpay as an appropriate solution for monetising your digital content (videos, PDFs, articles, music) and you are looking for a reliable partner, don’t hesitate and book a call with us. We will be happy to help you get started.